CO CDLE UITR-1 2006-2024 free printable template

Show details

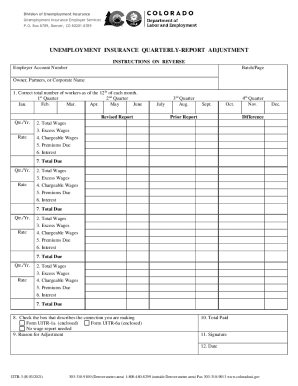

Colorado Department of Labor and Employment Unemployment Insurance Operations PO Box 956 Denver CO 80201-0956 303-318-9100 Denver-metro area or 1-800-480-8299 outside the Denver-metro area UNEMPLOYMENT INSURANCE TAX REPORT NOTE Unemployment Insurance UI Operations has moved from 1515 Arapahoe Street to 251 East 12th Avenue. If assistance is needed contact the Employer and tax Services Customer Contact Center at one of the above telephone numbers. Visit our Web site at www. coloradoworkforce....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your uitr 1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uitr 1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uitr 1 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit colorado uitr 1 form pdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out uitr 1 form

How to fill out Colorado UITR 1 form:

01

Start by obtaining the Colorado UITR 1 form from the appropriate source.

02

Read the form instructions thoroughly to ensure you understand the requirements and how to fill it out correctly.

03

Begin filling out the form by providing your personal information, including your name, contact details, and Social Security number.

04

Enter information about your previous employment, including the name and address of your employer and the dates of your employment.

05

Fill in the reason for your separation from each employer listed, whether it be resignation, termination, or any other circumstance.

06

Provide details about any income you received during the period in question, such as vacation pay, severance pay, or any other compensation.

07

Determine if you are eligible for any unearned income and report it accordingly.

08

Calculate your total earnings during the specified period and provide the necessary details.

09

If you have any dependents, provide their information as required.

10

Review the completed form for accuracy and make any necessary corrections.

11

Sign the form and date it.

12

Keep a copy of the form for your records.

Who needs Colorado UITR 1 form:

01

Individuals who have worked in Colorado and have become unemployed or are experiencing a reduction in work hours may need to fill out the Colorado UITR 1 form.

02

Employers who have terminated an employee or have experienced a reduction in workforce may need to provide the Colorado UITR 1 form to the employee.

03

The Colorado Department of Labor and Employment may require individuals to fill out the Colorado UITR 1 form to determine eligibility for unemployment benefits.

Video instructions and help with filling out and completing uitr 1

Instructions and Help about uitr 1 colorado form

Fill co uitr 1 form : Try Risk Free

People Also Ask about uitr 1

What is Colorado law on resignation?

Does Colorado require a separation notice?

Does Colorado require two weeks notice?

What is the SUTA limit for 2023 in Colorado?

How much does an unemployment claim cost an employer in Colorado?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out colorado uitr 1 form?

The UITR-1 form is the official form used to register a new business entity with the Colorado Secretary of State. The form requires the following information:

1. Entity name: The name of the business entity.

2. Entity type: The type of entity, such as a corporation, limited liability company, or limited partnership.

3. Duration: The duration of the entity, which can be either perpetual or a specific number of years.

4. Principal office address: The physical address of the entity’s headquarters.

5. Registered office address: The physical address where the entity’s records will be kept.

6. Registered agent name and address: The name and address of the registered agent who will receive service of process for the entity.

7. Purpose: The purpose of the entity, such as a business, charitable, or educational purpose.

8. Additional statements: Any additional statements or clauses the entity wishes to include in its formation documents.

9. Signatures: The signature of the individual filing the form, as well as the signature of any other individuals involved in the formation of the entity.

What is the purpose of colorado uitr 1 form?

The Colorado UITR 1 form is an Unemployment Insurance Tax Return used to report wages paid and unemployment insurance taxes due to the Colorado Department of Labor and Employment. It is used to compute the employer's annual unemployment insurance rate.

What is the penalty for the late filing of colorado uitr 1 form?

The penalty for late filing of a Colorado UITR 1 form is $25.00 per day, with a maximum penalty of $500.

What is colorado uitr 1 form?

It seems like there is a typo in your question. There is no specific form called "Colorado UITR 1" that is commonly known. It is possible that you may be referring to a specific form or document used by a particular organization or government agency in Colorado, but without more context, it is difficult to provide a specific answer. Please provide more details or clarify your question so that I can assist you better.

Who is required to file colorado uitr 1 form?

The Colorado UITR-1 form, also known as the Unemployment Insurance Tax Report, is required to be filed by every employer in Colorado who is liable for unemployment insurance tax. This includes any employer who has employed one or more individuals for at least one day in a calendar quarter in the current or preceding calendar year.

What information must be reported on colorado uitr 1 form?

The Colorado UITR-1 form is used to report information about a person's employment and wages for unemployment insurance purposes. The following information is typically required to be reported on the form:

1. Employer Information: The name, address, and federal employer identification number (FEIN) of the employer.

2. Employee Information: The name, address, Social Security number, and occupation of the employee.

3. Employment Details: The start and end dates of the employee's employment, the reason for separation (e.g., termination, layoff, resignation), and the number of hours worked per week.

4. Wages: The employee's gross wages earned during each calendar quarter, including any cash tips reported, bonuses, commissions, and other compensation.

5. Commissioned Salesperson: If the employee is a commissioned salesperson, additional information such as the gross sales made, the percentage of total sales the employee represents, and any deductions or advances provided by the employer.

6. Employer Liability: Details of any payments made by the employer on behalf of the employee, such as health insurance premiums, retirement plan contributions, or other fringe benefits.

7. State Income Tax Withholding: The amount of state income tax withheld from the employee's wages, if applicable.

8. Union Membership: Whether the employee is a member of a labor organization or covered by a collective bargaining agreement.

9. Federal Program Participation: Whether the employer is a government agency, educational institution, or nonprofit organization that participates in certain federal unemployment programs.

It is important to note that specific requirements or additional information may vary, so employers should consult the Colorado Department of Labor and Employment or a tax professional for the most accurate and up-to-date information.

How can I send uitr 1 for eSignature?

When you're ready to share your colorado uitr 1 form pdf, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find co uitr 1?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the uitr 1 form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in colorado uitr 1 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing form uitr 1 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your uitr 1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co Uitr 1 is not the form you're looking for?Search for another form here.

Keywords relevant to colorado uitr form

Related to uitr 1 form colorado

If you believe that this page should be taken down, please follow our DMCA take down process

here

.